Let's get real about fertility treatments and insurance

Reviewed by Health Guide Team,

Written by Chanel Dubofsky

last updated: Dec 11, 2019

5 min read

Here's what we'll cover

Before I started digging into all there is to know about fertility treatment coverage, I did an informal poll asking people about their personal experiences with the topic. Here’s what they had to say:

"It was almost all covered, but the meds (which are several thousands [of dollars] a cycle) were a constant battle to get."

"Nothing but the diagnostic testing and a few of the meds were covered. I think the meds were a clerical error — not really covered on purpose."

"It took so much work, but we got some money back. If we had just let the insurance company do their thing, we would not have gotten more than coverage for meds — which was still a significant cost. We were one of the few lucky ones."

"I was so lucky to have great insurance through my org when I did IVF in 2013 and most of one cycle was covered."

"Almost all my meds were covered, but the actual embryo transfer was not. My parents helped us pay for it, which is why we call him the baby my parents bought for us."

"In the five years of trying, I've never had anything covered. Not meds, not procedures. Nada."

If these experiences seem rather incongruous, that's because they are. Figuring out insurance and fertility treatments is seldom straightforward, but don't panic! We're here to make sure you have the information you need to navigate all of the complexity. Here’s what we'll go over:

How to know if your insurance will cover reproductive health and fertility treatments (and how to advocate for better benefits)

What we mean when we say "fertility expenses"

What you can learn from your insurance company's Explanation of Benefits (EOB)

Will insurance cover reproductive health and fertility expenses?

You can get out in front of the insurance coverage for fertility treatment debacle before you're even in it by finding out what your policy actually says. Here's how you can do that:

Call your insurance company's billing department to learn about how your benefits work.

Get to know your Explanation of Benefits (EOB) (more on this in the next section!).

Talk to your employer (and/or your HR rep) about what your plan covers, what it doesn't, and what could potentially be covered if it isn't already.

Before you go into a meeting or pick up the phone, prepare a list of questions to take with you. For inspo, check out The Muse's "Every Question You Have About Fertility Benefits at Work, Answered." These are a few of the questions they recommend:

What fertility testing is covered?

What are the limitations on coverage?

Are there age restrictions?

Are there marital status restrictions?

What does coverage look like for same-sex couples?

If employees make it clear that they’d be interested in a plan that covers fertility treatments, that could impact decisions about picking insurance providers in the future. Why? Because great fertility coverage can both attract and retain employees. Discussing fertility treatments at work, as well as with your friends, also destigmatizes infertility and allows for folks to talk about their experiences instead of perpetuating any silence or shame around the topic.

What are the expenses involved in fertility treatments?

For an in-depth explanation, check out our piece on the costs of egg freezing and IVF. Essentially, when we say expenses, we're referring to:

Doctor's appointments to evaluate what’s going on

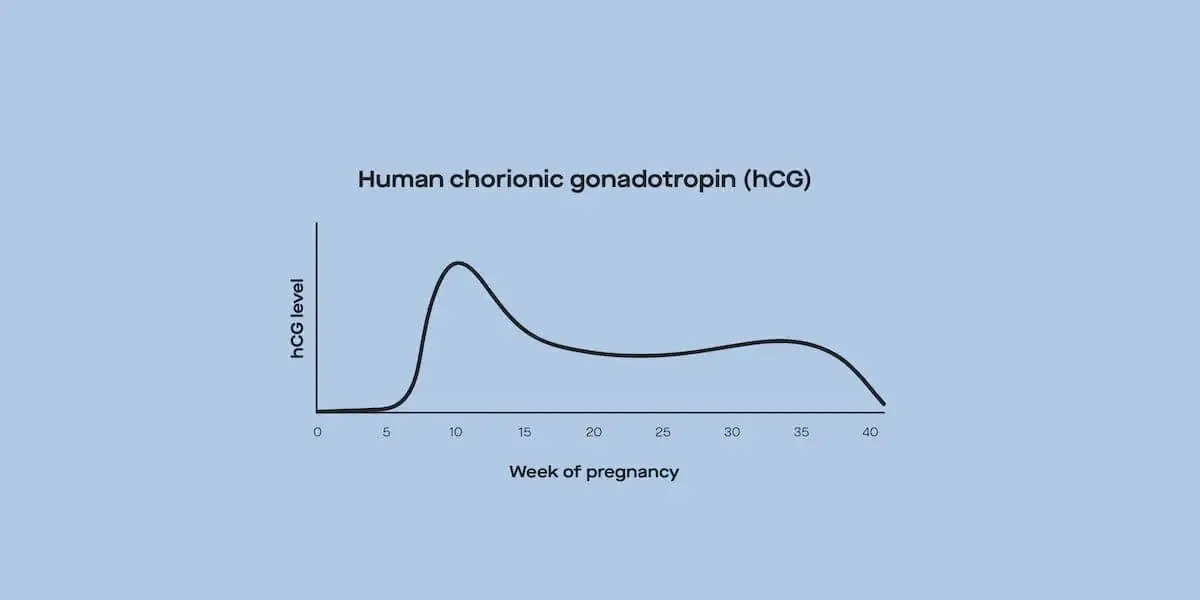

Blood tests to assess hormone levels (AMH, FSH, estrogen, etc)

An ultrasound (maybe more than one) to check for things like ovarian cysts, assess the condition of the fallopian tubes, and measure your antral follicle count (AFC) to find out your ovarian reserve.

If you're freezing your eggs, there are many things to consider — and keep in mind that you may end up doing more than one cycle to retrieve more eggs:

Hormonal birth control to promote ovulation

Drugs to inject yourself with to help your eggs mature

Anesthesia when you go into the clinic for the retrieval and the retrieval itself

Rent for the egg storage (some storage facilities offer a free first year, so be sure to see if that’s possible!)

If you're following up that egg retrieval with IVF or IUI instead of putting the eggs on ice, expenses include:

Fertilization of the retrieved egg

The cost of an embryologist (who monitors the embryo)

Injections to prep the uterine lining for receiving the embryo

The transfer process itself

These costs are going to vary if you're using donor eggs and/or donor sperm. As a reminder, it’s important to know that multiple rounds of IVF or IUI might be needed, so consider those additional costs when thinking about these treatments.

What’s an EOB and what will it include?

An EOB is an Explanation of Benefits — a document that outlines what your insurance policy will cover. When your provider submits a claim, an EOB will come in the mail. It’s not a bill, but it may contain information about amounts you will be billed for in the future. Not every EOB looks the same, but a standard one should include:

An overview of the services you received (like lab tests, surgery, consultation, etc) and who performed them

How much those services cost

The amount your health insurance plan paid

The amount your plan didn't pay

The amount you saved by visiting providers in your network

Any out-of-pocket expenses you'll owe you might owe

The amount that may have been paid from a Health Savings Account (HSA) and/or a Flexible Savings Account (FSA)

A glossary of the terms that show up in your EOB

Information on how you can appeal a claim

Did you have a procedure requiring anesthesia? Did you get X-rays? Those will be listed here, along with their costs.

For some examples of EOBs, check out this one from BlueCross Blue Shield North Carolina and this rundown on EOBs from Cigna.

Which fertility expenses will my insurance cover?

It depends on what plan you have. Insurance companies have medical boards — and that's who determines whether or not a service should be covered.

"Fertility coverage is highly variable and depends on what services the employer has selected," says Dr. Eve C. Feinberg, a reproductive endocrinologist (RE) specializing in infertility at Northwestern Medical Group.

Here’s what your insurance might cover:

Absolutely nothing

Only expenses related diagnostic testing to locate the source of fertility issues

Full coverage of therapies like IVF

Some combination of diagnostic testing and treatment

If you live in one of these 17 states, there are laws in place that require insurance coverage for infertility treatments. This means that:

If you have private insurance, you're still responsible for copays.

Coverage is only available once you've proven that you meet the criteria for infertility, which varies according to the state's law.

Group insurers may be required to offer coverage, but individual employers may opt out.

In some states, religious organizations are also allowed to opt out of coverage.

Additionally, there are seven states that legislate that insurance plans must cover treatments for folks whose infertility is medically induced (i.e. from chemotherapy, radiation, surgery, or other medical care that compromises fertility). Currently, both Massachusetts and New Jersey have active fertility preservation bills pending in their state legislatures. If these bills are passed, these states would be added to the list of those that require insurance plans cover medically induced infertility.

In May 2019, the Access to Infertility Treatment and Care Act (H.R. 5965 and S. 2920) was introduced by Representative Rosa DeLauro (CT) and Senator Cory Booker (NJ) into the US House and Senate. The bill would not only require healthcare plans and individual markets to cover fertility treatments, but also fertility preservation services. For more information on advocacy around these bills, check out the Alliance for Fertility Preservation.

So what does all of this mean for my fertility future?

If your insurance won't cover it, there are options for financing infertility treatments. FertilityIQ is a great resource for learning about financing treatments. There’s also the Kevin J. Lederer Life Foundation, a not-for-profit that provides financial assistance to individuals and couples in Illinois, Indiana, and Wisconsin to assist with the cost of infertility treatment or adoption. Dr. Eve Feinberg is their president and founder! According to Dr. Feinberg,"There are also over 50 private foundations in the United States that offer financial assistance to individuals and couples struggling with infertility." Many fertility clinics also have financial counselors who guide patients through the process of managing funding.

You deserve to feel powerful and informed when making decisions about your health and your future, and we're here to help make that happen.

DISCLAIMER

If you have any medical questions or concerns, please talk to your healthcare provider. The articles on Health Guide are underpinned by peer-reviewed research and information drawn from medical societies and governmental agencies. However, they are not a substitute for professional medical advice, diagnosis, or treatment.